nj electric car rebate calculator

Plug-in Electric Vehicles PEVs which are growing in popularity enable drivers to take advantage of a new vehicle technology that can save energy. NJ offers up to 5000 in rebates for Electric vehicles 500 for home charger installations.

Nj Resident Electric And Hybrid Vehicle Incentives Fred Beans Ford Of Langhorne

The New Jersey Board of Public Utilities offers state residents a rebate in the amount of 25 per mile of EPA-rated all-electric range up to.

. All Stations Map a Route Range From Full Charge Dealer. To apply call New Jersey E-ZPass at 1-888-AUTOTOLL 1-888-288-6865. Electric vehicles are qualified to receive reduced toll rates via the Green Pass Discount through their EZ Pass accounts.

5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission. Błogosławionej Piątki Poznańskiej w Poznaniu. Vehicles priced above 55000 would be ineligible for.

Office of the Governor Governor Murphy Affirms Electric Vehicle Rebate Eligibility Effective as of January 17 2020. During the required enrollment you must also provide proof of eligibility. Depending on income level up to 4000 rebate for purchase or lease of a new vehicle with a base price under 40000.

Plug-In Electric Vehicle PEV Rebate Program. They are often available at both the federal and state level and can vary depending on the size. This will result in varying incentive amounts for example.

Electric vehicles purchased after January 17th 2020 are. NDLA National Disability Leadership Alliance. Solar and Energy Storage.

Plug-in Electric Vehicles. A hybrid electric car with. NJDEP EV Calculator 10 Year Total Cost of Ownership Traditional Gas Vehicle.

Explore Electric Vehicle Affordability with calculators that determines your personal cost. Ad Select Models Eligible for Tax Credits. Visit the Kia Official Site for More Information.

You may only enroll in one discount program per qualifying vehicle. Quality Durability Backed by Our 10 Year100000 Mile Warranty. The New Jersey Board of Public Utilities offers state residents a rebate in the amount of 25 per mile of EPA-rated all-electric range up to.

The legislation creates a Light Duty Plug-in Electric Vehicle Rebate Program to encourage the purchase of light-duty plug-in electric vehicles over a ten-year period. Plug-In Electric Vehicle PEV Rebate Program. There are many different federal and state incentives to make the transition easier.

For a list of all requirements consult the. It Pay to Plug In provides grants to offset the cost of purchasing electric vehicle charging stations. A fully electric car with 200 miles of electric range or more will qualify for a 5000 rebate.

The bill was signed into law and took effect on. Over 9000 in California EV rebates and EV tax credits available. New Jersey Electric Vehicle Incentives Calculator.

10 discount on the off-peak rate for the New Jersey Turnpike and Garden State Parkway. PSEGs Clean Energy Future Electric Vehicle EV Program received approval to invest 166 million to build out New Jerseys EV charging infrastructure which will have customer and. Incentives MPG Electricity PricekWh Gas Pricegallon Battery Size in kWh Fuel Cost Electric Range.

This is an average for New Jersey residential electricity rates. To find your own price per kilowatt-hour divide total costs by kWhr and take an average over both winter and. President Bidens EV tax credit builds on top of the.

The program is designed to expand New Jerseys growing network of. The new incentive program offered a point-of-sale rebate of up to 500000 on the purchase or lease of a new electric vehicle. Zespół Szkół Salezjańskich w Poznaniu.

Customers must enroll in the plan and provide proof of eligibility. New Jersey Electric Vehicle Incentives. The PHEV rebates are the same 25 per mile and are also based on electric range.

The PHEV incentive sunsets after 2022. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. As electric vehicle technology becomes less expensive the amount of incentives will decrease.

Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA. So if you are waiting to buy a Tesla. On January 17 2020 Governor Murphy signed S-2252 into law PL2019 c362 which created an incentive program for light-duty electric vehicles and at-home electric charging infrastructure.

Publiczne Salezjańskie Szkoła Podstawowa Liceum im. Nothing About Us Without Us.

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Vehicle Incentives What You Need To Know

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

What Electric Vehicle Rebates Can I Get Rategenius

Electric Vehicle Tax Credit What To Know For 2020

What Electric Vehicle Rebates Can I Get Rategenius

Resources For Electric Vehicle Ownership And Charging In New Jersey

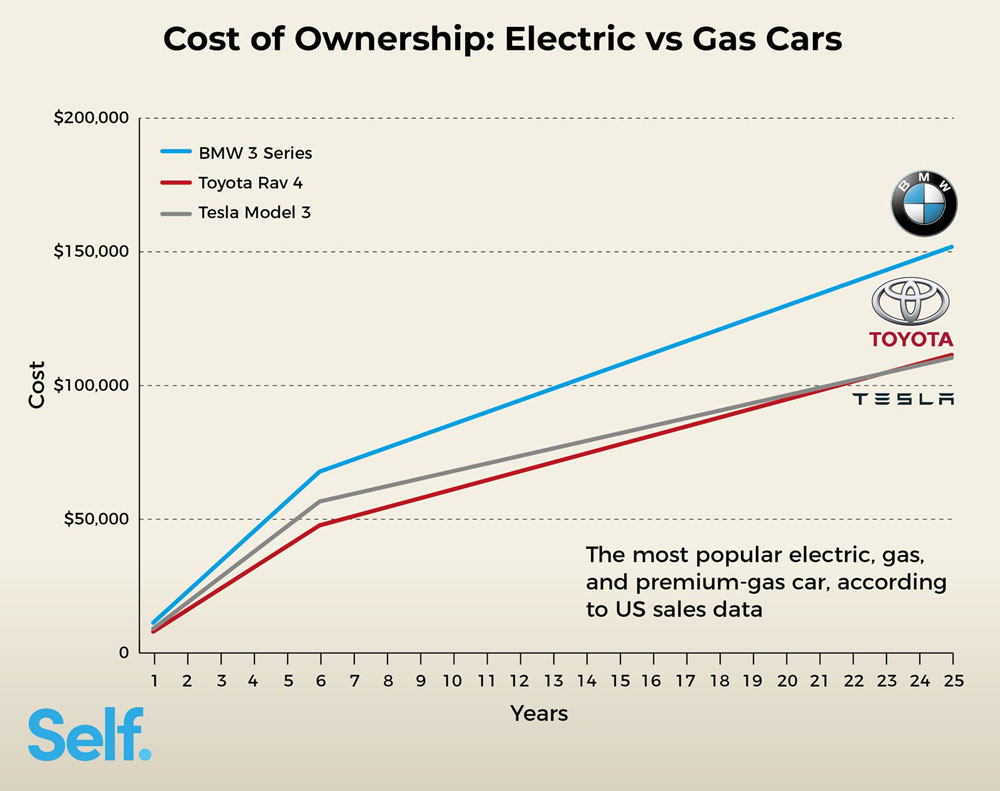

Electric Cars Vs Gas Cars Cost In Each State Self Financial

Electric Vehicles Should Be A Win For American Workers Center For American Progress

Electric Vehicle Charging Station South Orange Millburn Nj Ev Charging Station All City Electrical Lighting Generators Supplies

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Top 5 Most Affordable Electric Vehicles Pg E Ev Savings Calculator

New Jersey Electric Vehicle Incentives New Jersey Solar

Electric Vehicle Charging Station South Orange Millburn Nj Ev Charging Station All City Electrical Lighting Generators Supplies